What is trading? (Easy to understand)

Everyone who is interested in the news has heard such a term as trading, but not everyone knows what it really is. Now everything will change. Now we will consider what trading is, what kinds it has, and who it does below in this article.

What is trading?

This is a kind of activities which is realized by the way of good money. This kind of work is done on special exchanges by some people. These people are always called traders (participant of the trades). In most cases, here are represented people who have money to invest.

Who is involved in trading?

For instance, someone has the good job or successful business. So, he has a lot of funds (money) to provide sufficient material means for his family, while he has savings or available funds that can be invested in some profitable business. Should he give these funds to become interest-bearing? At this time any bank can suddenly go bankrupt, and if not – then inflation will “eat” a small part, which does not stimulate to rely on such financial institutions in the crisis. Kept in a safe at home? Start to create an own start-up? Invest in real estate? This is often dead-end ways with a lot of shortcomings – it takes a lot of money (buying real estate, for instance), then a lot of time – is your business … And serious risks.

Trading – is what for?

This is to earn. This is a kind of activity, due to which you can multiply your financial resources many times. Actually, of course, you need to proceed – fools with money cannot survive there.

You have two ways – to trade on your own or give money to management. Money management – in fact, the same risks, which specialist will you get, and what will be the “kitchen” whether your brokerage company.

After all, a trader, basically, is an ordinary seller. The one who buys at a lower price and sells at highest as he/she can. But since trading is commerce on the stock exchange, without a direct agreement with the client, the task seriously becomes complicated. The trader conducts a constant analysis of the value of the goods, which today is predicted to sell well, find a way to invest in this product as small as possible money and by the end of the set time to get the maximum amount of profit from the trade operation.

However, for those who are familiar with the exchanges for a while, it is no longer a secret that trading is a work that penetrates the network more and more like a computer, soon it will be in every house. After all, you can get to the stock exchange via the Internet, which allows you to try yourself in this area for all experienced Internet users.

Previously, access to a closed trading network could be obtained through brokers, who in turn opened it only by request and, of course, for good money. Of course, financial trading for normal people was something unattainable. Brokers played mostly large-scale or were useless (profitability went into a negative if the profit from the long-term transaction was less than 15 thousand dollars). So there was a necessity for traders. They invest their savings in the goods which they chose as desired. The trader determines the time period when to trade and he will take his profit. No mediation, excluding the stock exchange.

Necessary skills

So, what does a trader need? Good theoretical basis, knowledge of the trading rules, trade algorithms, understanding how the stock exchange works, an ability to plan, accrued capital, permanent analysis of transactions on the exchange. It is necessary to keep statistics of your transactions and notice your mistakes, and develop new trading strategies, draw the conclusions.

What the feature of Internet trading?

Nowadays many exchanges have convenient access via the World Wide Web. This provides more effective monitoring of prices and turnover, opens up new opportunities for beginning traders and colossal for professionals. Since the main tool of the trader is technical and fundamental analysis, the Internet is the best environment for the timely collection of information and operational forecasting of the charts necessary for accurate determination of goods and prices. The analysis, in turn, is necessary for the most profitable investment and the subsequent extraction of the maximum profit, and only Internet-trading is an opportunity to make profit remotely and in the shortest possible time.

For example, if Europe tomorrow will impose sanctions on the import of agricultural products to Russia, then there will be a shortage of this product in Russia. What does this mean? The fact that if a trader is immediately invested in the agricultural sector, where the prices have not yet managed to grow then tomorrow when they have already risen, he will get his profit. What was to be done? Follow the news, turn on your logic, have free funds and promptly respond at the exchange. That’s the whole job, and Internet trading is a universal tool because it was on the network that effective trading became possible, the complicated procedures that frightened brokers ever before it existed online.

Types of trading

There are several types of trading. We will analyze each of them in detail. The first type is a financial trading. This is a type of trading on the stock exchange, where traders work exclusively with securities or shares. Since the price is regulated by demand, a competent trader can easily determine what is better to buy or sell at the moment.

For example, if the demand for shares of one company will increase, it is clear that soon the price for these shares will raise – the main thing is to catch this connection. The trader takes everything in his hands and buys as much as he can on credit at the current, not yet raised the price. And it turns out that in his hands will get a net profit – the difference between tomorrow and today’s price. So, he sold the shares, in fact, not having them. He just bet on his analysis. He could lose and stay in debt. This is a real financial trading. Many people, probably, have repeatedly seen movies where ill-wishers of certain brokers or traders specifically, at a loss to themselves, “break” the forecasts of such traders to leave them in debt. Sometimes it happens.

The second type is high-frequency (algorithmic) trading. This is a type of trading, which is carried out by computers that perform millions of computing operations per second and, on the basis of these operations, independently execute all securities purchase and sale deals. Analysts say that this type of trading stabilizes the use of markets and reduces the cost of trade. But this method has many disadvantages. High-frequency trading is focused on short-term, even second-time operations, yielding such a small profit and working on small commodity turnover that has often led to a collapse of markets.

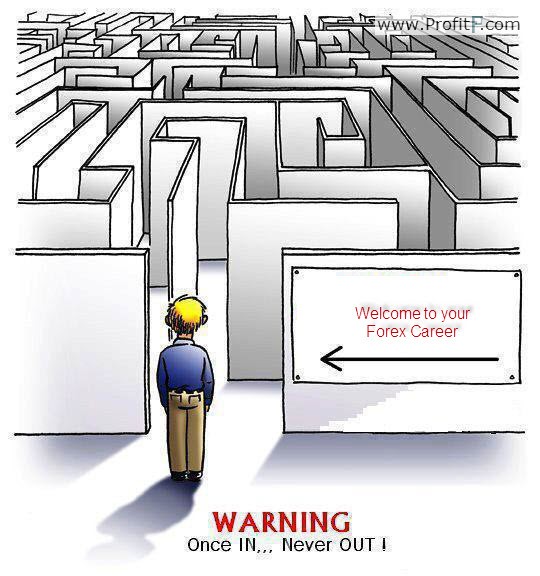

The third type of trading is Forex trading or playing in the foreign exchange market. After America moved away from the stable change in the currency in the price, it became possible to earn good money on it. Still, because its value can “float” in the range of four percent during the day. Then the world community under the general noise and created an international monetary system, that’s why it becomes possible to earn money. Nothing complicated. You know that if you had a lot of dollars a year ago, you would surely have sold them now when they cost twice as much. Traders also know this. Moreover, they can earn on it within a few seconds, making bets on a certain currency, based on their assumptions that the demand for this currency is about to rise, and it will rise in price, after which it can be profitable to sell. Therefore, today Forex trading is a powerful system for earning money for many Internet users and people who trust them to manage their money for managing and gaining profit.

But there are some shades. First are the levels on Forex which can float for a couple of cents because of a large number of applications and different brokers. Therefore, Forex trading is more difficult on a more relaxed Russian and European market. Secondly, large movements in currency pairs are less frequent than, for example, on the shares of the American market. Third nuance – thanks to the developed system of shoulders on Forex, where you can come with a minimum deposit and trade, literally starting with $100.

Resume

Trading means selling (trading) on the stock exchange, with the purpose of buying and profitable to sell. The computer can trade, a hired trader or you personally. In any case, to understand the basics of the stock exchange and learn at least the classic schemes of buying and selling it is necessary to control your assets, and to trade by yourself.